Status quo analysis and prospect forecast of global tobacco packaging industry

Tobacco Packaging Industry Overview and Statistical Scope

Cigarette packaging materials mainly include lining paper for cigarettes, trademark paper, seal paper, packaging film for cigarettes, and drawstrings.

Lining paper: The wrapping paper lining the inner layer of the cigarette pack (small packet), which has a certain moisture-proof protection effect on the cigarette. According to the processing method, it can be divided into composite lining paper and vacuum sprayed aluminum paper.

Trademark paper: The wrapping paper used for wrapping cigarette rods and boxes. Generally, the cigarette brand name, trademark pattern, manufacturer's name, number of cigarettes and tar are printed on it. Cigarette trademark paper mainly includes coated paper, cardboard, white cardboard, gold and silver cardboard, laser cardboard and recycled paper.

Seal: Rectangular label paper for gluing the open end of the small box. Mainly used for sealing the open end of cigarette soft packs. The seal paper is mainly divided into flat seal paper and reel seal paper. According to the application function, it can be divided into ordinary seal paper and anti-counterfeit seal paper.

Cigarette packaging film: a layer of transparent packaging film on the outer packaging of cigarette packs (small packets) and rods in order to prevent the cigarettes from being damp, the loss of moisture and aroma of the cigarettes, and to improve the appearance quality of the products. With BOPP film.

Pull String: A thin strip (thread) of transparencies used in cigarette packages for easy opening. Commonly used materials are PET and BOPP.

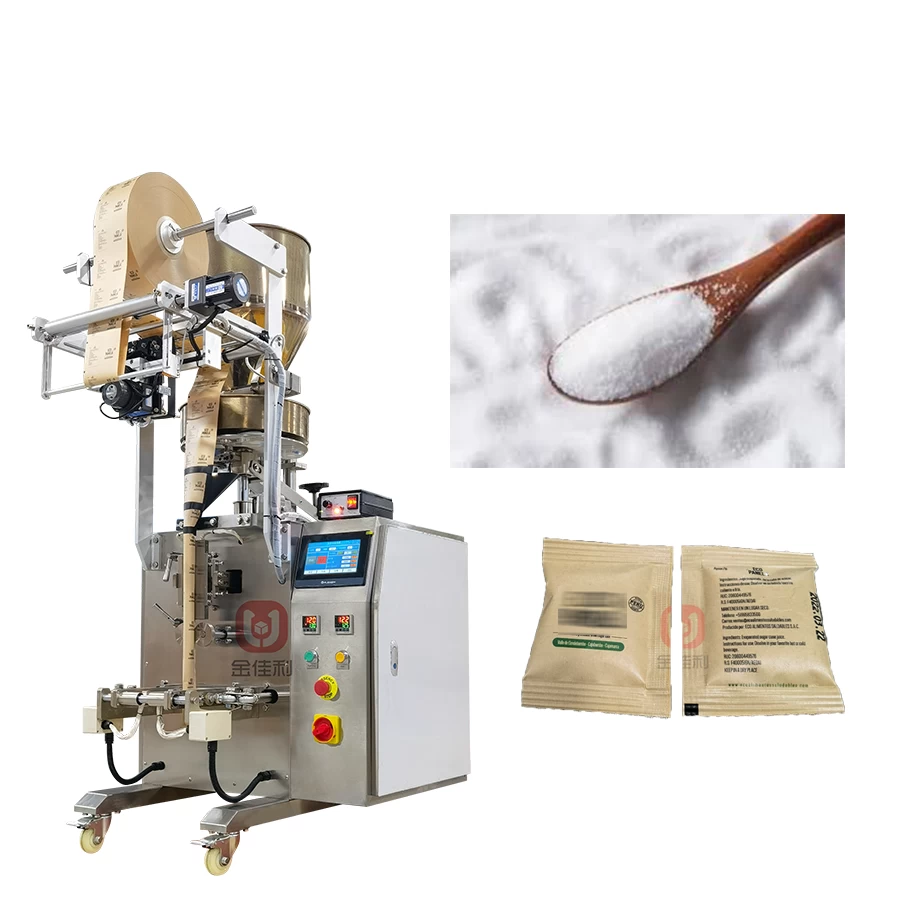

Chewing tobacco packing machine china

General overview of the development of the tobacco industry

On the whole, the number of packaging enterprises in my country is large and the scale is small, the industry concentration is not high, the phenomenon of repeated construction is serious, and the core competitiveness of the industry is not strong. Compared with developed countries in the world, my country's paper printing and packaging industry The industrial structure and technological level are still relatively backward. In the paper printing and packaging industry, the competition in the low-end packaging field is particularly fierce; in the high-end field, there are relatively few high-quality large-scale enterprises with high-end brand customers, high-precision production technology, and high service quality, and the industry concentration is relatively lower than that of domestic low-end packaging. Slightly higher, but still low compared to the packaging industry concentration in developed countries.

Tobacco Packaging Development Trend

The tobacco industry faces enormous challenges, not least with changing legislation and the persistent problem of counterfeiting. Many countries ban advertising, sponsorship and free tobacco samples. Packaging that communicates with consumers and strengthens the brand image is extremely important for advertising. Beautiful packaging with trim is now the norm in many markets. As tobacco-related health concerns grow, regions such as Australia, Japan and Europe have introduced "plain packaging" designed to remove branding elements from packaging. This is expected to impact the tobacco industry's total packaging consumption value in these markets. For other countries with less stringent regulations, a booming retail industry, increasing online sales, and rising smoking population are expected to drive demand for tobacco packaging products, especially paper products. Cardboard boxes are expected to maintain solid growth due to favorable environmental conditions. Cigarettes account for 27% of the total value of counterfeit and substandard products in the EU, so all brands are working to address the threat, and governments are closely watching the impact of tobacco smuggling on tax revenues (US$10 billion in lost tax revenue in the US alone, and the EU in $6.5 billion). New printing technologies with holograms, invisible inks and more complex packaging designs are the way to complicate and reduce counterfeiting in Western markets.

Development Status and Prospect Forecast of Tobacco Packaging Industry

In 2020, the global tobacco packaging market size reached USD 10,964.7 million, and is expected to reach USD 12,658.9 million in 2027, with a compound annual growth rate (CAGR) of 2.07%.

From a regional perspective, the Chinese market occupies a relatively large global market. The market size in 2020 is US$4,315.1 million, accounting for about 71.24% of the global market. It is expected to reach US$4,786.7 million in 2027, when the global share will reach 69.77%. ; Europe, the Middle East and Africa also accounted for 21.54% and 13.36% of the market share accordingly.

In terms of product type and technology, it is divided into paper materials and film materials. In 2020, the revenue of paper materials is 10335.1 million US dollars, accounting for 94.26% of the market share; the sales volume of paper materials is 2105.9 thousand tons, while The film material is only 242.1 thousand tons, mainly due to the small amount of film used in cigarette packs.

From the perspective of product market application, cigarettes are divided into low-end cigarettes, mid-range cigarettes and high-end cigarettes, occupying 10.0.3, 45.97% and 41.87% of the market share respectively in 2020. With the increasing living standards, low-end cigarettes account for The ratio will continue to decline, and the corresponding proportion of mid-range cigarettes and low-end cigarettes will increase by a certain percentage.

At present, major global manufacturers include Amcor, WestRock, Jinjia, Dongfeng, Mayr-Melnhof Packaging, ITC Limited, Guilian Holdings, Jinshi Technology, Shaanxi Jinye and Enjie, etc. The share of major manufacturers in 2020 will exceed 37% %; the foreign market concentration is slightly higher than that of the domestic market, while the domestic concentration is relatively scattered. Among them, Jinjia and Dongfeng, as the industry leaders, together account for about 15% of the domestic market; with the policy restrictions on the tobacco industry, the overall scale of the industry is affected by Certain influence, it is expected that the industry competition will be more intense in the next few years, especially in the Chinese market.